Focus

Forsyth Barr Focus presents a perspective on key market dynamics. These are designed to highlight issues we believe are particularly relevant for long-term investors, and to focus on opportunities that will benefit portfolios in the years ahead. If you have any questions, your Forsyth Barr Investment Adviser, supported by our research team, is available at any time to provide you with further insight and advice.

Fonterra’s Pivot: Trimming the Fat, Keeping the Cream

23 June 2025

When Fonterra announced plans to divest its consumer brands business in May last year, many New Zealanders were surprised. The portfolio — now dubbed Mainland Group — includes household staples and recognisable brands such as Anchor milk, Mainland cheese, Primo milk, and Fresh’n Fruity yoghurt. Some viewed the move as an admission by Fonterra of its failure to add value. However, we see it as a pragmatic recognition of where Fonterra excels.

Avoid the Home Market Bias

12 June 2025

When it comes to investing, familiarity often feels like safety. But for many investors—particularly here in New Zealand—this comfort can come at a cost. Home market bias is a behavioural tendency of investors to allocate a disproportionate share of their funds to their local market. Unfortunately, this bias can quietly dent the long-term performance and resilience of a portfolio.

Warren Buffett: Timeless Lessons from the Oracle of Omaha

16 May 2025

This month marked the end of an era: 94-year-old Warren Buffett announced his retirement as CEO of Berkshire Hathaway. Known as the ‘Oracle of Omaha’, Buffett is the world’s most famous investor, admired not only for his stellar investing track record but also for his humility and wisdom. His approach to investing and life provides timeless lessons for investors.

Addressing New Zealand’s Growing Water Quality Issues

1 May 2025

Clean water is one of our most precious natural assets – but it is finite. Pressure on water resources is reaching a critical level both in New Zealand and globally. Demand for clean water is on an upward trajectory as the global population grows, more economies industrialise, and urbanisation trends continue. At the same time, our aged infrastructure and increasingly intense weather events are exacerbating the demand. We outline key global and local challenges in clean water management and look at how one US-based global company, Xylem, is leveraging technology to help solve some of these pressing issues.

Trumped-Up Volatility: Keep Calm and Carry On

29 April 2025

Markets have been extremely volatile over the past two months. For most, watching the value of your investments swing wildly is disconcerting. In times like these, it can be tempting to batten down the hatches and retreat from the market. Our advice: act only after calm and careful consideration. History highlights that emotional, reactive decisions during periods of volatility are often detrimental to your long-term wealth.

Farewell to Free Trade? Trump’s Tariffs Rattle Markets

7 April 2025

President Donald Trump’s 2 April ‘Liberation Day’ tariff announcement marks one of the most sweeping trade policy shifts in modern history and has sent shockwaves through global markets. The magnitude and breadth of tariffs, and the rapid pace of implementation, surprised investors and raised serious concerns about an escalating trade war and its impact on the global economy. Unfortunately, it is now clear that the Trump administration is inclined to surprise, and policy can evolve rapidly and significantly. This makes for a tricky, disconcerting environment for investors. The key is to remain level-headed, maintain a well-diversified portfolio, and focus on the long term.

Growth vs. Value Investing: It’s Not One or the Other

21 March 2025

Different investors take different approaches. The two most widely recognised styles in equity markets are growth and value. Sometimes the debate around which approach works best can feel like a religious war, with both sides dogmatically arguing their case. In our view, however, all investments need consideration of both a company’s growth prospects and its valuation – the two are intrinsically linked. More broadly, maintaining exposure to both styles in a portfolio can be beneficial. Different strategies perform better under different market conditions. A well-diversified mix can enhance a portfolio’s resilience over the long term.

Women and Wealth: Taking Charge of Financial Futures

27 February 2025

Women in New Zealand retire with significantly less savings than men – sometimes tens of thousands of dollars less – despite living longer. This financial disparity, known as the ‘retirement wealth gap’, leaves many women vulnerable when they should be enjoying financial security. Why does this gap persist, and more importantly, how can we close it?

Interest Rates Cut Again

20 February 2025

The Reserve Bank of New Zealand (RBNZ) has delivered another 50 bps interest rate cut, bringing the Official Cash Rate (OCR) down to 3.75%. This latest reduction is part of an ongoing effort to revive economic activity amid softening inflation and sluggish growth. Further cuts are expected, with the OCR likely to finish the year closer to 3%, impacting businesses, investors, and everyday savers.

Tariffs: Trump Card or Bluff?

7 February 2025

President Trump campaigned on tariffs, and in his first two weeks he came out swinging, announcing new tariffs on Mexico, Canada, and China. Although tariffs on Mexico and Canada were quickly deferred, they are clearly a key part of Trump’s playbook. The will-he, won’t-he nature of Trump’s trade policies creates a challenging environment for businesses and markets, with the rules of engagement unclear and subject to rapid change. Uncertainty and volatility are likely to remain features of the Trump presidency.

DeepSeek: A Threat to AI Optimism?

30 January 2025

How many people had heard of DeepSeek a month or so ago? We hadn’t. But in the past few days this Chinese artificial intelligence (AI) company has grabbed global headlines and shaken the share prices of some of the world’s largest companies. While investing in new and exciting industries like AI can deliver outstanding returns, the sudden emergence of DeepSeek serves as a reminder that unpredictability and volatility are also part of the ride.

ESG: Weathering the Storm

16 December 2024

Forsyth Barr has completed its third annual assessment of Carbon, Environmental, Social, and Governance (C&ESG) ratings for New Zealand companies. The transition to a more sustainability-focussed economy is underway. But it has been a testing year for progress. Growing greenwashing concerns and scrutiny of companies’ aspirations has challenged the authenticity of C&ESG efforts. Economic volatility and changing political agendas have been additional headwinds.

Down, Up, Down... Riding the Interest Rate Rollercoaster

9 December 2024

The New Zealand economy has been on a turbulent journey over the past few years, with interest rates falling, rising, and now falling again. Since August, with inflation now looking under control, the Reserve Bank of New Zealand (RBNZ) has cut rates, with further reductions expected in 2025. Interest rate changes impact everyone—businesses, borrowers, savers, and investors.

Investing Outside the Public Domain: Why Private Markets Are Worth Considering

14 November 2024

Private markets are one of the fastest growing areas of the investment universe. Investors have been attracted by the strong returns and diversification benefits they have delivered. There are trade-offs, most typically a lack of liquidity, a long investment horizon, and uncertainty around timing of returns. In our view, however, for many investors the benefits private markets provide outweigh the costs.

US Election 2024: Trump Triumphs

8 November 2024

America has voted and Donald Trump is hired (again). Following a highly contested and historic election, Trump has reclaimed the presidency with a decisive mandate, winning not only the required electoral college votes but also the popular vote. Although some votes remain to be counted, Trump has already secured a clear victory, convincingly over the 271 electoral college votes needed to clinch the presidency.

Interview with Precinct Properties’ CEO Scott Pritchard: Laying Foundations for Future Growth

07 October 2024

Many people’s first thought of Precinct Properties is as the owner of prime office buildings. Office, as a sector, has had its challenges, particularly through COVID. What is the state of the office market today, and how are things like working from home impacting your business?

There’s definitely a two-tiered market in both Auckland and Wellington. What we’ve seen since COVID is a real flight to quality. Businesses have recognised that in order to optimise their workforce’s productivity, they are better off having their workers in the office the majority of the time.

Community Finance: A Win-Win for Investors and Our Community

07 October 2024

Foundations for the Future: Investing in Infrastructure

24 September 2024

Interest rate cuts rolling in

27 August 2024

US Election 2024: Stars, Stripes and Stocks

24 July 2024

The End of High Cash Rates is Nigh

15 July 2024

Tiwai Point: 20 More Years

03 July 2024

Aged care: Demographics is Destiny

04 June 2024

Responding to Trust Tax Changes: Not as Easy as PIE

19 April 2024

Auckland Future Fund

11 April 2024

We're Only Human

5 April 2024

Interview with Don Braid of Mainfreight

8 March 2024

Peak to peak: Record highs are business as usual for markets

29 February 2024

ESG: Charting the course of change

12 February 2024

The Wisdom of Charlie Munger

1 December 2023

Coalition tweaks and turns

29 November 2023

Weighing the GLP-1 Impacts

9 November 2023

Cash Isn't Always King

6 November 2023

The AI-mazing Race: The Rush for Artificial Intelligence

24 October 2023

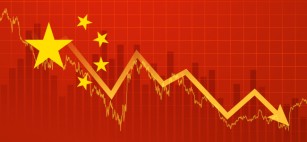

China's Economic Challenges: From the Tiger's Roar to a Lingering Cold

26 September 2023

Embracing Uncertainty

20 September 2023

Ballots and bulls - Do elections impact financial markets?

11 September 2023

Reflecting your values in your investment portfolio

4 August 2023

An investment seesaw: The ups and downs of property syndicates

20 July 2023

Stocks vs. Property: The House Doesn't Always Win

29 June 2023

Debt Wars: A game of political chicken

17 May 2023

Cracks in the Kiwi Nest Egg

4 May 2023

March Madness: Banking Tremors Cross the Atlantic

22 March 2023

Infratil: An Infrastructure Forerunner

22 March 2023

The Chips Are Down: Silicon Valley Bank Failure

15 March 2023

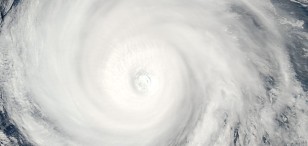

When it rains it pours: Cyclone Gabrielle a further challenge for the New Zealand economy

23 February 2023

New Zealand tourism: 100% Pure at 70% Capacity

7 February 2023

ESG: How New Zealand companies measure up

21 December 2022

House prices are tumbling... and that's okay

14 December 2022

Cryptocalypse: The Wild West of financial markets

24 November 2022

Investors Beware: Self-Inflicted Pain Can Hurt the Most

22 November 2022

Investing Fads: Hazardous to Your Wealth

1 November 2022

Riding the Inflation Rollercoaster

6 October 2022

An interview with David Mair - CEO of Skellerup

23 September 2022

The Blue Economy

1 September 2022

Q&A with Katie Beith

25 August 2022

Bear Up, Bear Markets Don't Last Forever

26 July 2022

More Than Ever, Focus Matters

17 June 2022

Sunny side up

27 May 2022

Solar is about to become part of New Zealand’s generation mix. One hundred and seventy three thousand terawatts of solar energy strikes the Earth continuously — more than ten thousand times the world’s total energy use. But, when it comes to New Zealand’s electricity market’s transition away from fossil fuels, solar has long been spurned in favour of alternatives such as geothermal and wind. However, over the past 18 months there has been a tectonic shift in view. We’ve seen a flurry of announcements of intentions to build grid-scale solar that has now reached about 8.75 terawatt hours (TWh), the equivalent to around 20% of New Zealand’s current electricity consumption.

How rising interest rates impact your bond portfolio

20 April 2022

Typically investors think about bonds as being the stable safe part of their portfolio. Over the past 18 months or so this hasn’t been the case and bond prices have seen some of their sharpest falls in history. This is a good news and bad news story. While the market value of bonds has fallen, for investors who plan to own them to maturity these “losses” on bonds aren’t permanent – they will still receive the same interest on their investment and be repaid in full when the bonds mature. Furthermore, those investors reinvesting their money today will receive a higher return going forward.

An interview with Jolie Hodson - CEO of Spark

1 April 2022

Despite the rapid growth in the use of their services, telecoms generally haven't been a great hunting ground for investors over the past decade or so. Companies have struggled to balance the rapidly changing industry and the need to continually invest in new technologies, with delivering appropriate returns to shareholders. Notwithstanding this challenging backdrop, Spark has delivered as one of the best performing telcos globally.

![]()

Lessons from the World’s Worst Investor

25 March 2022

This is a tale about John Smith, the world’s worst (or maybe just unluckiest) investor. Before you feel too sorry for John, don’t worry, we’ve made him up! In reality it would be hard to be as bad or as unlucky as John even if you really tried.

Russian roulette: Where to from here?

28 February 2022

Russia’s invasion of Ukraine is shocking. It is Russia’s first military engagement in Europe since 1945. Sadly the early signs are that the fighting will be bloody. Russia’s effrontery clearly emphasises the world has become a much more fractious place and geopolitical shocks are on the rise. That said, whilst the human cost of the Ukraine invasion is tragic, we expect the economic cost will most likely be contained and the market’s current heightened concerns will ease.

History (sometimes) Repeats

25 February 2022

My mother was born 200 kilometres north of the current Ukrainian border, in an area once part of Poland, now part of Belarus. In 1940, she and her family were deported from their rural home to a forced labour camp in Siberia by the Soviet Red Army. Trauma and privation are intricately woven into the historical narrative comprising this part of the world.

Markets not having the happiest new year

28 January 2022

For investors in equity markets it has been a tough start to the new year. In fact, in the United States — by far the largest equity market in the world, the S&P500 index has had the worst start on record dating back to 1929. No one enjoys watching the price of their investments jump around, so it’s understandable if some investors feel unsure and nervous. Unfortunately, however, volatility in markets is normal. It’s the price we pay to earn higher returns over the long-term.

New Zealand’s housing market: Built of bricks or built of cards?

21 January 2022

On any measure New Zealand house prices are extreme. Even before we’d ever heard of COVID-19 there was much consternation about the country’s “housing crisis”. Since COVID hit, house prices have soared and unaffordability has gotten worse. Much worse.

Spotlight on Climate Change: Closing the gap between rhetoric and action

20 December 2021

In November, governments met (and underwhelmed many) at COP26. Throughout the year, frustrations at the slow pace of action spilled over into the streets and the topic of climate change made its way into boardrooms, courtrooms and parliamentary sittings.

The Tricky Transition to Sustainable Energy

23 November 2021

The world is pushing to reduce carbon emissions and energy markets are set for significant change, with electricity a key benefactor as transport and industry seek non-fossil fuel energy sources. However, renewable electrification of the globe is not straightforward and comes with significant challenges.

Good COP or bad COP?

5 November 2021

Over the past 20 months or so the global community’s focus has been on combating the COVID crisis. For two weeks (at least) it will shift back to the slower-moving challenge of climate change.

Inflation soaring like it's 1989

21 October 2021

This week the Consumer Price Index (CPI), New Zealand’s principal measure of inflation, hit 4.9%. Outside of when oil briefly exceeded US$140/bbl in 2008 and the impact of GST hikes in 2010, you’d have to go back to the late 1980s to see headline inflation at higher levels. New Zealand isn’t the only country facing heightened inflation pressures, but we are near the front of the pack. Economically, we are a small open nation, which, prior to COVID, had largely relied on migration to drive economic growth. While shut borders and supply chain disruptions are impacting countries everywhere, the impact here has been even more pronounced.

An Index is no more than a 'Rule of Thumb'

17 September 2021

A share market index measures the performance of a basket of stocks. Indices are an important tool in financial markets. They are used to calculate the performance of a market; active investors often benchmark their performance against an index, and passive investors generally try to replicate the performance of an index.

Long live the home office?

31 August 2021

The return to Alert Level 4 lockdown has seen the majority of the workforce resume working from home, which, once again, brings the future of the office back into the spotlight. There has been much discussion around what offices will look like in a post-COVID-19 era, with many predicting a reduction in demand for office space. While we believe there will be a change to the way we work, we still see a future for the office in the modern workplace.

Delta Blow

19 August 2021

New Zealand has been hit with its first community outbreak of COVID-19 in six months. That it comes in the form of the Delta strain raises the risks. Delta is significantly more infectious than earlier variants and has become the dominant strain of COVID-19 around the world. There is good news and bad news for New Zealand investors. The good news is vaccines are still proving to provide a high level of protection against new variants meaning, whilst they might slow the global economic reopening, they hopefully shouldn’t derail it. The bad news. New Zealand is the least vaccinated country in the Organisation for Economic Cooperation and Development (OECD).

Interest rate rises: New Zealand racing for gold or silver

23 July 2021

Last week market expectations for New Zealand interest rates shifted sharply. It now looks like a two-horse race over the next couple of months between our Reserve Bank and Norway’s Norges Bank as to who will be the first developed market central bank to hike rates in a post-COVID world. In contrast, earlier this month, the Reserve Bank of Australia reiterated its “central scenario” remains that it doesn’t expect to hike rates until 2024, while the United States Federal Reserve’s projections are it will commence with hikes in 2023. How has New Zealand found itself at the head of the pack to tighten monetary policy?

A Changing Climate

25 June 2021

The Climate Change Commission’s (CCC) final report to the government, Ināia tonu nei: a low emissions future for Aotearoa, outlines a view for New Zealand that, if adopted by the government, will dramatically reshape the country over the coming decades. It clearly signals that the road to carbon neutral 2050 will be one driven in an electric vehicle and lined with charging stations where petrol pumps now stand.

Lending with Purpose

11 June 2021

Last month Precinct Properties issued the latest “Green bond” in the New Zealand fixed income market. Precinct joins a growing list of companies that have opted for this relatively new type of financing. In this article we unpack some key issues around the increasingly common issuance of Green, Social, and Sustainability (GSS) bonds and how they can help investors incorporate responsible investment, sustainability, and Environmental, Social and Governance (ESG) objectives into their fixed income portfolios.

Global Supply Chains: Containing the Issue

20 May 2021

With modern-day shopping reduced to a few clicks of a button it can be easy to forget the logistical challenge involved in delivering a package to your doorstep within a few days — not to mention sourcing all the raw materials to produce the product. March’s Suez Canal blockage, caused by the jammed 400m-long Ever Given, brought the importance of global supply chains to the attention of many. Supply chains, however, were already stretched to the limit long before this.

Portfolio Diversification: Unpacking the Free Lunch

30 April 2021

Portfolio diversification is a core principle of long-term investing and has been called the only free lunch in finance. What does that mean?

The primary goal of diversification is not higher returns, but to minimise the risk and volatility (the free lunch) of a portfolio for a given long-term expected return. We unpack why diversification is one of the key tools in an investor’s toolbox.

Crossing the ditch in a bubble

1 April 2021

Prime Minister, Jacinda Ardern, is due to announce the timing of two-way, quarantine free, travel between New Zealand and Australia on Tuesday, 6 April. The proposed ‘trans-Tasman bubble’ has been on the cards since May last year but repeatedly scuppered by new COVID-19 outbreaks on both sides of the Tasman and seemingly less desire from our government, until now. Mounting political pressure appears to have hastened it into action. Excluding the prospect of further community outbreaks on either side of the Tasman or a worsening of the current situation in Queensland, we foresee a two-way bubble opening before the end of April.

Government 'cracking down' on housing 'speculators'

25 March 2021

This week the Government released a policy package to address New Zealand’s “housing crisis”. In our view elevated house prices is principally a supply issue — the population has grown quickly, and the provision of new homes has failed to keep pace. The policy package does include some initiatives to help supply, but the focus is on the demand-side, specifically targeting investors who own around 35% of New Zealand’s residential properties. It seems likely these policies will encourage some investors to switch from housing to other asset classes and, at very least, cause house price growth to slow. Ultimately though, more supply-side solutions are required.

![]()

One-two jab: Virus on the back foot, but not a knock-out blow

10 March 2021

COVID-19 vaccines are being rolled out around the world. New Zealand’s vaccination programme is now officially underway. Today around 320 million people globally have received at least one dose. The good news is the early evidence suggests that vaccines are at least as effective as the clinical trials concluded. Optimists may be forgiven for therefore thinking the end of COVID-19 is in sight. Unfortunately however, whilst vaccine rollouts are undoubtedly a positive step in the fight against the virus, we do not expect they mean a return to a pre-COVID world any time soon.

![]()

Sleepy Joe causes a power surge

15 February 2021

The last two months have been a wild ride for the share prices of two New Zealand electricity companies, Meridian Energy and Contact Energy. Over recent weeks the GameStop saga (see last week’s Focus article) captured global headlines of how a band of Redditors took on short seller hedge funds, causing wild swings in some companies’ share prices. Closer to home, the case of Meridian and Contact presents another way stock prices can diverge from underlying value.

![]()

GameStop: An entertaining sideshow

10 February 2021

Market news headlines over the past couple of weeks have been dominated by a tug-of-war between an army of retail investors (using social media and online trading platforms) and some short-seller hedge funds.

![]()

Funding for Lending

4 December 2020

In response to the economic shock of COVID-19 and part of Reserve Bank of New Zealand’s (RBNZ) ‘least regrets’ strategy, a new ‘tool’ is being rolled out next week, which will see the major banks able to access funding at extremely low rates of interest.

![]()

The Three Vaccineers

26 November 2020

The last few weeks has seen a flurry of positive news on COVID-19 vaccines. The potential impact of these vaccines (and possibly others) on economies and companies are front of mind for investors.

![]()

From Housing Gloom to Housing Boom

19 November 2020

Back in April, economists were grabbing news headlines with predictions of sharp house price declines. The housing market typically does not do well in a recession, and closed borders shut the door on demand from new migrants. Economists, however, could not have been more wrong. In October we saw house prices hit record highs in every region of the country. Why was economists’ pessimism so misplaced?

![]()

Markets Pfizzing on vaccine hopes

10 November 2020

Overnight, pharmaceutical company Pfizer with biotech partner BioNTech announced that the initial phase III trial results have found their COVID-19 vaccine to be “more than 90% effective”.

![]()

You're fired?

6 November 2020

Although not said with the same conviction as the former The Apprentice star, it appears President Trump will likely be removed from office. But, in the highest turnout election since 1900, the results were closer than betting odds and many polls predicted. It’s been a roller-coaster few days, with both parties claiming victory and President Trump spreading (or more accurately, tweeting) accusations of voter fraud.

![]()

The Red Pill or the Blue Pill

30 October 2020

The markets’ attention next week will squarely be on the US election.

Will Democrat Joe Biden oust Republican incumbent Donald Trump from the Presidency? Will the result be clear on the day, or will we have to wait days or even weeks to know for sure? Will we see a “Blue Wave” with Democrats sweeping the Presidency, Senate and House of Representatives, or will Congress remain split?

![]()

Every cloud has a (tech) silver lining

25 September 2020

“Like it or not we live in interesting times. They are times of danger and uncertainty; but they are also the most creative of any time in the history of mankind” Robert Kennedy.

54 years on, as we grapple with the first global pandemic in over a century, Robert Kennedy’s words still seem as relevant as ever. It’s easy to feel overwhelmed by negative headlines and doomsayer predictions, but history teaches us good times usually follow bad. And bad times have often been the catalyst for a step change in research, discovery, and innovation.

![]()

Bonus Bonds - The house was the winner

4 September 2020

1970 — The Beatles released their final album ‘Let it Be’, Brazil became the first team to win the FIFA World Cup three times, pirate radio station Radio Hauraki was finally awarded a license, and the New Zealand Government launched Bonus Bonds through the Post Office Savings Bank.

![]()

Lockdown déjà vu, but not for the NZX

14 August 2020

After 102 days of no community transmission of COVID-19 in New Zealand, our largest city Auckland, with around a third of the country’s population and about 38% of GDP, is back in lockdown. Clearly this will come as a bitter disappointment to most but isn’t really a huge surprise.

![]()

Twice Halved

3 August 2020

Does anyone in financial markets care about Covid anymore? Looking at the performance of the US sharemarket, one could be forgiven for thinking not.

![]()

Injection of optimism in the search for a vaccine

27 July 2020

Over the past few months, we’ve been inundated with medical jargon and talk of a COVID vaccine. Every day seems to bring news around a potential vaccine or medical treatment. Markets are increasingly optimistic a medical treatment will be found. With a recent string of more tangible news, are we finally starting to get some real traction?

![]()

Power cut for Tiwai smelter

10 July 2020

Nearly a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercargill (with a small number of cabinet ministers in support), to open the aluminium smelter at Tiwai Point.

![]()

KiwiSaver and the magic of compounding returns

3 July 2020

When KiwiSaver started in 2007, there was a stampede to sign up. There was the $1,000 kickstart dropped into your account and that, along with the contributions from government and employers, had people asking “why wouldn’t you?” There was no sensible answer to that question and so people joined in droves. (There are now over 3,000,000 members)..

Ryman Healthcare: An interview with Gordon MacLeod

26 June 2020

Ryman Healthcare is a New Zealand success story. It is the country’s largest retirement village and aged care operator, and in 2014 it opened its first village in Victoria, Australia, where it continues to expand. Ryman listed on the NZX in 1999, raising NZ$25 million at a market capitalisation of NZ$135m. Since then it has grown to now be valued by the market at NZ$6.5 billion.

Mainfreight: Special People, Special Company

19 June 2020

Mainfreight listed on the NZX on 14 June 1996, at 96c per share. Since then, and after adjusting for a 1 for 10 bonus issue in 2002, its share price has climbed by an average annual compounded rate of +17% before accounting for the added benefit of dividends. It has the second highest (marginally behind Ryman Healthcare) total shareholder return of any stock on the NZX since initial public offering (IPO) that has been listed since 2000. For every NZ$1 invested in its IPO, investors would now have a whopping NZ$149 compared to a little under NZ$10 if they’d put the same NZ$1 into the market index. Read more about the Mainfreight story...

Investing or speculating?

12 June 2020

Overnight we saw the largest drop in equity markets since 13 March. Investors’ pursuit of safety has pushed up the price of defensive assets. The yield on United States 10-year Treasury bonds has tightened from 0.95% to 0.65% over the last week (remember, when bond prices rise, the yield on offer falls).

The changing face of retail

5 June 2020

Lenin said nothing can happen for decades, and then decades can happen in weeks. Although not quite a decadal shift, there is no doubt that the COVID-19 pandemic has pulled forward the future of retail. Consumer purchasing behaviour has changed, effectively overnight. While many consumer behaviours will revert once the COVID-19 threat eases, we expect that recent changes in the way people shop could prove enduring.

Are negative interest rates on the way?

29 May 2020

The concept of “negative interest rates” is one many of us will struggle to comprehend. Will I have to pay the bank to hold my cash? Will the bank pay me to have a mortgage? These two common questions almost seem surreal, however, the reality is that not much is likely to change. Negative retail interest rates for both depositors and borrowers are still very uncommon in countries that have negative central bank interest rates.

Accelerating the digital revolution

22 May 2020

Lockdown measures around the world have forced many people and businesses to change how they communicate, how they buy and sell goods and services, and how they spend leisure time. While we expect most will largely return to previous ways of living and working once restrictions are lifted, we do expect some lasting change.

Budget 2020 - The Government responds to a global pandemic

15 May 2020

"Houston we have a problem”, might well have gone through Grant Robertson’s mind as he crafted the government’s 2020 Budget in response to the COVID-19 global pandemic. Like most of the world, New Zealand has been severely impacted as the virus placed extreme pressure on the global economy. Few escape when borders are closed and non-essential businesses are shut-down for several weeks. Because the Budget was drafted at the height of a crisis, it’s unlikely to be perfect.

Trade War 2.0

8 May 2020

Although Covid-19 dominates the headlines, the US Presidential election, due November 3rd, creeps closer. The election looked tight before the Virus Crisis. Now it’s on a knife edge. A tight race and rebounding share market may tempt President Trump to reignite a trade confrontation with China too, amongst other things, emphasise his global heft to voters.

![]()

The gang’s all here: “Mr Market”, “Tina” and “FOMO”

1 May 2020

Well, for most of us it’s been a unique month. We’ve been isolated within our bubbles, maybe socialising over Zoom, binge-watching Netflix, home-schooling the kids, or (by the looks of it) desperately craving takeaways. And, if you hadn’t noticed, equity markets had their strongest month in over 33 years.

![]()

Contain or eliminate?

24 April 2020

A COVID-19 mass vaccination campaign is unlikely for at least a year to eighteen months. But an antibody therapy or experimental vaccine that’s proven safe may be available sooner, and be able to be produced in sufficient quantities to protect high-risk people. Regardless, New Zealand’s goal to eliminate the virus has implications for our economy, with major implications for businesses that rely on demand from sectors such as travel, tourism, education, and migrant labour.

![]()

A post-pandemic world

17 April 2020

Signs are emerging that the global infection rate from COVID-19 may have peaked. While some countries are further ahead than others in the battle against the pandemic, the overall trend is looking more promising.

![]()

Will Tina Play an Encore?

9 April 2020

The past week has been a good one for equity markets, responding to slowing new COVID-19 cases in hot spots like Italy, Spain, and potentially New York. Here in New Zealand, it appears the lockdown is working – fingers are crossed that measures may be eased sooner rather than later.

![]()

Living in a bubble

3 April 2020

It really is quite remarkable how quickly the world can change. Two months ago most New Zealanders were happily enjoying summer. Most of us had never heard the terms coronavirus, social distancing or self-isolation before. Today we’re living in our bubble, hoping it’s only for three more weeks, but nervously suspecting it might be longer. The future is uncertain. If it wasn’t, investing would be easy.

![]()

Understandable anxiety

20 March 2020

For the vast majority of people, the current COVID-19 crisis is unprecedented. The human and societal impacts are sobering. Financial market volatility has remained extreme. Investor anxiety at such a time is entirely understandable. And it is human nature to want to seek safety. History firmly underlines that acting on these instincts is detrimental to long-term investment returns.

Copyright Forsyth Barr Limited. You may not redistribute, copy, revise, amend, create a derivative work from, extract data from, or otherwise commercially exploit these publications in any way. These publications have been prepared in good faith based on information obtained from sources believed to be reliable and accurate.

Any recommendations or opinions in these publications are general in nature and do not take your personal circumstances into account. For personalised financial advice contact your Forsyth Barr Investment Adviser.